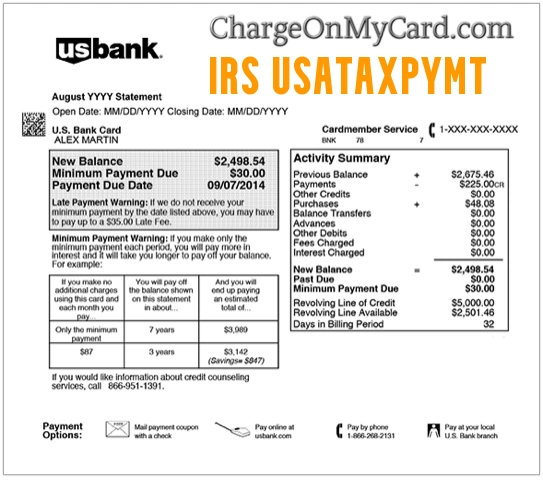

The specific charge statement code is IRS USATAXPYMT, and it pertains to the tax payment systems provided by the United States government for taxpayers to make federal tax payments electronically.

Decoding the Charge: IRS USATAXPYMT on Bank, Credit Card and Debit Card Statements

If you come across IRS USATAXPYMT on your credit card or bank statement, it signifies an electronic payment made to the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection.

IRS Contact Information

For further details, you may reach out to the IRS directly:

- IRS Internal Revenue Service

- Address: 111 Constitution Avenue, NW, Washington, D.C. 20024, USA

- irs usataxpymt phone number: 1-800-829-1040

- Business Helpline: 1-800-829-4933

- Website: irs.gov

More about IRS USATAXPYMT

The IRS USATAXPYMT system is designed to offer a convenient, efficient way for taxpayers to pay their federal taxes. It removes the need to send checks via mail or make in-person visits to a tax office. Moreover, it offers confirmation of payment and enables taxpayers to schedule future payments or track their payment status online.

Your bank or credit card statement will reflect IRS USATAXPYMT, usataxpymt irs alongside the payment amount and date when a tax payment is made via this system.

Related Charge Codes

ach irs usataxpymt

irs des usataxpymt

irs des:usataxpymt

pnp billpayment fl

Other Frequently Searched Charge Codes

In addition to IRS USATAXPYMT, consumers often search for these other charge codes:

- CHKCARDZARA USA INC 800-535-4027

- APL*APPLE ONLINE STORE 800-676-2775

- AMZN Mktp US*MB94F3OJ3

- GOOG*Nest Labs

- GOOGLE AMAZON MOBILE

- CAT SALES CHARGE

- FID BKG SVC LLC MONEYLINE

- PNP Bill Payment

Why Rely on ChargeOnMyCard.com?

At ChargeOnMyCard.com, we believe that financial transparency is vital. We’ve developed a comprehensive, user-generated database to shed light on baffling charges. Each entry is meticulously verified by live personnel, ensuring accurate, trustworthy, and up-to-date information. By fostering a community of users sharing experiences and insights, we aim to make your financial statements clearer and more understandable.

Disclaimer

Please be aware that this website isn’t affiliated with the IRS or any other company mentioned here. This information is provided for consumer assistance and reference purposes. For official information about any charges on your statement, always contact your bank or the respective company directly.