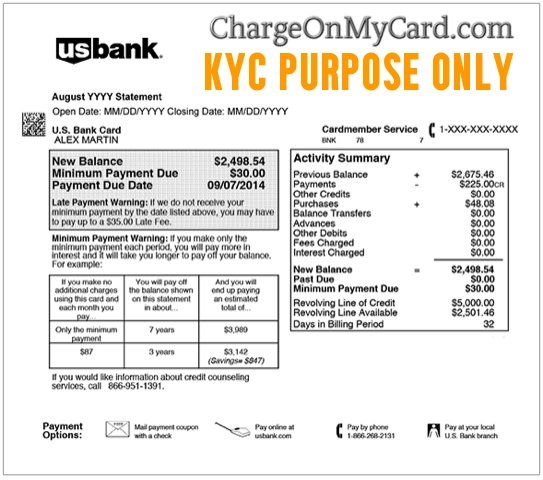

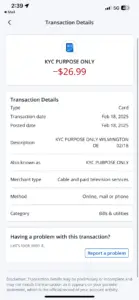

Have you noticed a charge labeled KYC Purpose Only Wilmington DE on your credit or debit card statement and are unsure what it’s for? You’re not alone. Many individuals are puzzled by this descriptor. We’re here to help you understand the possible reasons it might appear and what steps you can take if it’s unfamiliar.

What Is the KYC Purpose Only Wilmington DE Charge on Your Financial Statements?

The term KYC stands for “Know Your Customer,” which is a standard process used by financial institutions, fintech companies, and other businesses to verify the identity of their clients. A billing descriptor containing KYC Purpose Only Wilmington DE could imply a one-time verification charge or hold from a compliance or identity verification service located in (or routing through) Wilmington, Delaware.

Possible Explanations for the Charge

-

Identity Verification Fee

- Some platforms or services (e.g., cryptocurrency exchanges, online banks, or lending platforms) require a KYC process to comply with regulations. A nominal charge or hold may be placed on your card for verification.

-

Fintech or Online Banking Services

- If you recently opened a new online bank account, financial app, or digital wallet, the process might list a small descriptor like KYC Purpose Only to confirm your payment method or identity.

-

Background Check or Compliance Check

- In certain cases, background or compliance checks might involve a small authorization charge on your card that appears under this descriptor.

-

Unauthorized or Fraudulent Activity

- If you have not used any service requiring KYC or do not recognize the transaction, the charge could be fraudulent, especially if it doesn’t match any activity you’re aware of.

What to Do If You Don’t Recognize the Charge

If you’re unsure about the origin of the KYC Purpose Only Wilmington DE 19808 charge, consider the following steps:

1. Review Recent Transactions

- Check Account Activity: Look through your emails, receipts, or any recent account openings or verifications that might align with the date and amount of this charge.

- Ask Household Members: If someone else has access to your card or account, verify that they haven’t recently opened or verified an account using your payment method.

2. Attempt to Identify the Service

- Search for KYC Processes: Think of any new accounts or services you may have recently signed up for that would require identity verification.

- Review Banking/Fintech Apps: If you downloaded a new banking or fintech app, check its FAQs or billing statements to see if they mention a KYC fee or hold.

3. Consult Your Financial Institution

- Report the Charge: If you suspect fraud or simply can’t trace this charge to any authorized activity, contact your bank or credit card issuer immediately to dispute it and protect your account.

- Fraud Alerts: Ask about setting up transaction alerts or additional security measures.

- Request a New Card: If fraud is confirmed, obtaining a new card can help prevent further unauthorized charges.

Share Your Experience and Help Others

We encourage you to share any information or experiences you have regarding the KYC Purpose Only Wilmington DE charge in the comments below. Your insights can be invaluable to others facing similar confusion. Consider discussing:

- How you discovered the charge

- Any interactions you’ve had with a potential KYC-related service

- Steps you took to resolve the issue

If you’ve encountered the KYC Purpose Only Wilmington DE charge and have insights or experiences, please share them. Your input can help others in similar situations.

You May Also Be Interested In

- SP Plus Atlanta GA Charge

- Endicia Charge

- Wilborniti Charge

- Yourself First Charge

- CSC Service Work Charge On Card

- Foris Dax Inc Charge

Frequently Asked Questions

Is the KYC Purpose Only Wilmington DE charge legitimate?

In many cases, a KYC-related charge is legitimate if you recently opened or verified an account that requires identity checks. However, if you have not used any services requiring KYC or do not recognize the transaction, it’s important to verify with your financial institution.

How can I confirm whether the charge is from a KYC verification process?

Look for recent sign-up confirmations or identity checks in your email, texts, or banking/fintech apps. Additionally, you can contact your bank to see if they have more merchant details.

What should I do if I suspect the charge is fraudulent?

Contact your bank immediately to dispute the charge and safeguard your account. They can help with investigations and may issue a new card if necessary.

Why Trust ChargeOnMyCard.com?

At ChargeOnMyCard.com, our mission is to promote financial transparency and assist consumers in identifying mysterious charges on their statements. Our user-driven database is curated to ensure accuracy and timeliness.

Disclaimer

ChargeOnMyCard.com is an independent platform and is not affiliated with any banks, KYC providers, or companies mentioned. We offer information for educational purposes, including user feedback, reviews, and comments. All details regarding KYC Purpose Only Wilmington DE are user-reported. Verify potential discrepancies with your financial institution.