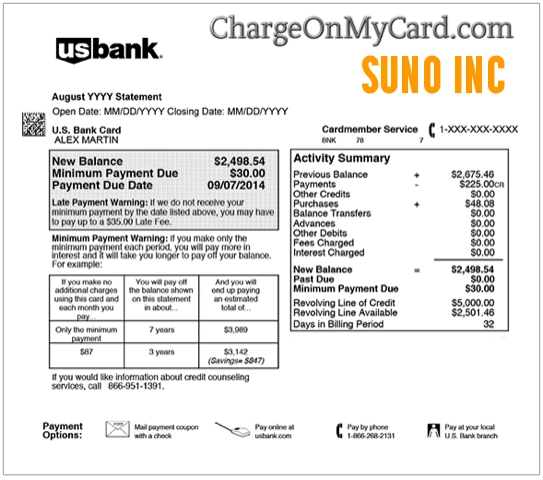

If you noticed a charge labeled Suno Inc on your credit or debit card and don’t recognize it, you’re not alone. Many people search for this charge after spotting it on their bank statement and trying to figure out whether it’s legitimate, a forgotten purchase, or something that should be disputed. Below is what we currently know and the steps you can take.

What Is the Suno Inc Charge?

At this time, the Suno Inc charge appears on some card statements without a clear public explanation of the company or service behind it. There is limited verified information available, and the charge does not appear to be associated with a widely recognized brand or retailer. This lack of clarity is what causes concern for many cardholders.

Why Might Suno Inc Be Charging My Card?

While the exact source of the charge is unclear, common possibilities include:

- Online purchases or subscriptions: Some digital products, services, or trial offers bill under less recognizable company names.

- App or in-app purchases: Charges made through mobile apps or games may appear under a parent or processing company name.

- Third-party payment processing: The billing descriptor may not match the website or service you interacted with.

- Unauthorized or fraudulent activity: If you do not recognize the charge at all, fraud is a possibility.

What Should You Do If You Don’t Recognize the Charge?

If the Suno Inc charge looks unfamiliar, take these steps:

- Review recent transactions: Check your email for receipts, confirmations, or subscription notices.

- Check with family members: Someone with access to your card may have made the purchase.

- Look at the charge amount and date: These details often help identify the source.

Contacting Suno Inc

Currently, there is no widely published or verified customer service contact information for Suno Inc. If your card statement includes a phone number or reference code tied to the charge, that may be your only direct lead.

When to Contact Your Bank or Card Issuer

If you still can’t identify the charge:

- Report the transaction to your bank or credit card company.

- Ask about dispute options and fraud protection.

- Request a replacement card if unauthorized activity is suspected.

Frequently Asked Questions

Is the Suno Inc charge legitimate?

At this time, it is unclear. Due to limited public information, cardholders should verify the charge directly with their bank.

How can I find more details about the Suno Inc charge?

Your bank may be able to provide additional merchant data tied to the transaction, such as processing information or a merchant ID.

What should I do if I believe the charge is fraudulent?

Contact your bank or credit card issuer immediately to dispute the charge and protect your account.

Related Charges People Ask About

You may also want to review these similar charge explanations:

- Brooks and Cedar Charge

- Astro Bargain Charge

- AGA Service Company Charge

- Active Interest Media Charge

- PMUSA Tolling Charge

Why Use ChargeOnMyCard.com?

ChargeOnMyCard.com helps consumers understand confusing credit and debit card charges using clear, plain-language explanations. Our content is based on user reports and careful review, helping you decide whether a charge is legitimate or needs further action.

Disclaimer

ChargeOnMyCard.com is an independent consumer information website and is not affiliated with Suno Inc. Information is based on user reports and publicly available data. Always contact your bank or card issuer for official verification or disputes.