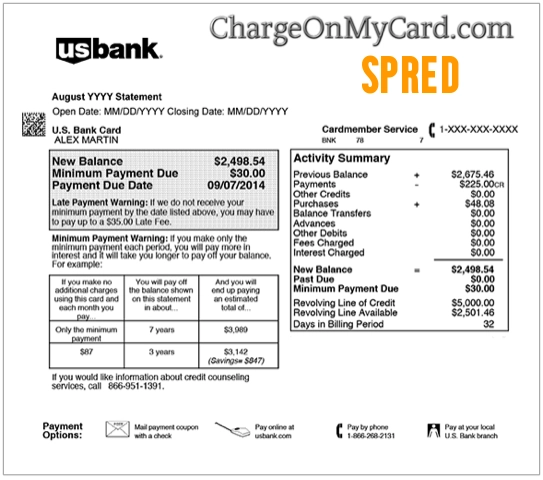

Have you noticed a charge labeled Spred on your credit or debit card statement and are unsure what it’s for? You’re not alone. Many individuals are puzzled by this unfamiliar descriptor. We’re here to help you understand what it might be and what steps you can take.

What Is the Spred Charge on Your Financial Statements?

A Spred charge has occasionally appeared on users’ statements without a clear explanation of its origin. Currently, there is limited publicly available information about the company or service behind this charge, contributing to the confusion among cardholders.

Possible Explanations for the Spred Charge

Here are some scenarios that may account for a Spred charge:

- Online Purchases or Subscriptions

- It could be tied to an online store, service, or subscription platform that bills under the name Spred.

- E-Commerce Transactions

- Some smaller or international vendors might appear on statements with shortened or otherwise unrecognizable descriptors like Spred.

- In-App or Digital Purchases

- Certain mobile apps or games use third-party billing services that show up under generic names such as Spred.

- Unauthorized or Fraudulent Activity

- If you do not recognize the charge at all, this may be a sign of unauthorized card use.

What to Do If You Don’t Recognize the Charge

If you’re unsure about the origin of the Spred charge, it’s best to act quickly:

1. Review Recent Transactions

- Check Purchase History: Look through your emails, receipts, and account orders to see if any transaction aligns with the amount and date of the Spred charge.

- Ask Household Members: If anyone else has access to your card, verify that they haven’t made any purchases or signed up for a service.

2. Contact Spred (If Possible)

Because there is limited information about Spred, finding a direct phone number, email address, or website may be challenging. If your statement provides any contact details, consider reaching out for clarification—but be cautious and only provide essential information.

3. Consult Your Financial Institution

- Report the Charge: If you suspect fraud, contact your bank or credit card issuer immediately to dispute the charge and protect your account.

- Fraud Alerts: Ask about enabling fraud alerts or other security measures.

- New Card: If fraud is confirmed, requesting a new card can prevent further unauthorized charges.

Share Your Experience and Help Others

We encourage you to share any information or experiences you have regarding the Spred charge in the comments below. Your insights can be invaluable to others facing the same issue. Consider discussing:

- How you discovered the charge

- Any interactions you’ve had related to this charge

- Steps you took to resolve the issue

If you’ve encountered the Spred charge and have insights or experiences, please share them. Your input can help others in similar situations.

You May Also Be Interested In

Frequently Asked Questions

Is the Spred charge legitimate?

It’s unclear whether Spred is legitimate due to the lack of publicly available information. If you don’t recognize the charge, it’s important to verify by reviewing your purchase history or contacting your financial institution.

How can I find out more about the Spred charge?

You can search online or check consumer forums for references to Spred, as well as ask your bank for more merchant details. Any phone number or website listed on your statement may also help you uncover more about the charge.

What should I do if I suspect the charge is fraudulent?

Immediately contact your bank to report the charge and protect your account. They can help you dispute the transaction and may issue a new card if necessary.

Why Trust ChargeOnMyCard.com?

At ChargeOnMyCard.com, we aim to provide clarity and transparency for confusing or unknown charges. Our user-generated database helps consumers identify peculiar billing descriptors, offering insights and potential resolutions.

Disclaimer

ChargeOnMyCard.com is an independent platform and is not affiliated with Spred or any other companies mentioned. We offer information for educational purposes, including reviews, feedback, and user comments. While we strive for accuracy, details about Spred are user-reported, and we encourage you to verify any discrepancies with your bank.

Note: Due to limited information regarding Spred, we welcome anyone with direct experience to share further insights. This collective knowledge can help others identify and resolve similar issues.