Steps to Take When You Encounter Unauthorized Charges on Your Credit Card Statements or Bank Account Statements

If you discover unfamiliar or unauthorized charges on your banking or credit account, don’t panic. Here are the steps you should take immediately:

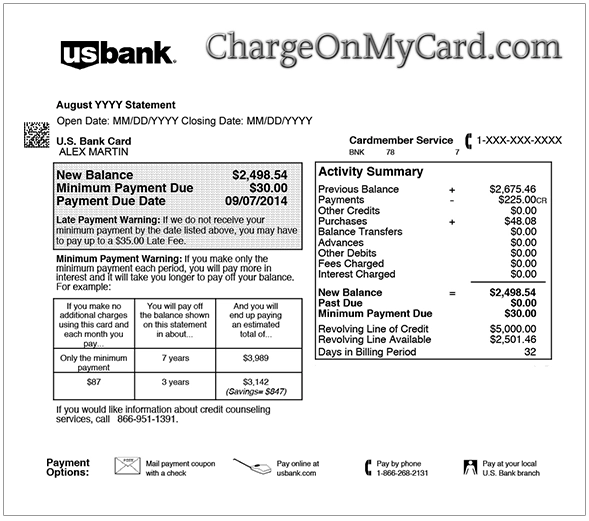

- Contact your bank or credit card company: As soon as you notice any dubious charges, reach out to your financial institution. Prompt notification can significantly limit your financial liability. While you can call them, it’s recommended to follow up with a written notice. This gives you a record of your correspondence.

- Send a written notification: Your bank or credit card provider should have given you instructions on how to report suspected unauthorized use of your account. Remember, the address you send this notification to might differ from the one where you usually send your payments.

Once your bank receives your notice, it has the responsibility to conduct a reasonable investigation if it plans to hold you liable for any part of the unauthorized use. The bank’s review of your claim might include several actions:

- Analyzing the disputed transaction in relation to your usual purchases.

- Checking whether the goods or services were delivered to your residential or business address.

- Comparing the signature on the transaction with your confirmed signature.

- Asking for a police report.

- Requesting additional documents to validate your claim.

- Asking for a written statement from you or any authorized user.

- Asking for information about your awareness of the person who allegedly used your card without permission, or whether they were authorized to use it.

At the conclusion of its investigation, the bank is obliged to inform you of the results. If the bank concludes the charges were indeed unauthorized, it should rectify the situation, typically by refunding the unauthorized amounts.

Remember, always be vigilant when it comes to your bank or credit account statements. Regularly review them to catch any unauthorized charges early. This can help you prevent potential fraud or identity theft.

Disclaimer: This article is intended to provide general advice and may not apply to every individual’s circumstances. Always contact your bank or financial institution for professional advice tailored to your situation.

How do I dispute an unauthorized charge?

To dispute an unauthorized charge, immediately contact your bank or credit card company. Report the charge and provide as much detail as you can. Following up in writing is often beneficial. The bank or credit card company will then initiate an investigation into the unauthorized charge. Always monitor your accounts regularly for any further unauthorized activity